Here are the most common TicketBAI errors and their solutions. Remember, we are continuously improving, so not all issues may be identified in this article.

You can check the status of invoices in FISCAL SETTINGS, accessing Files:

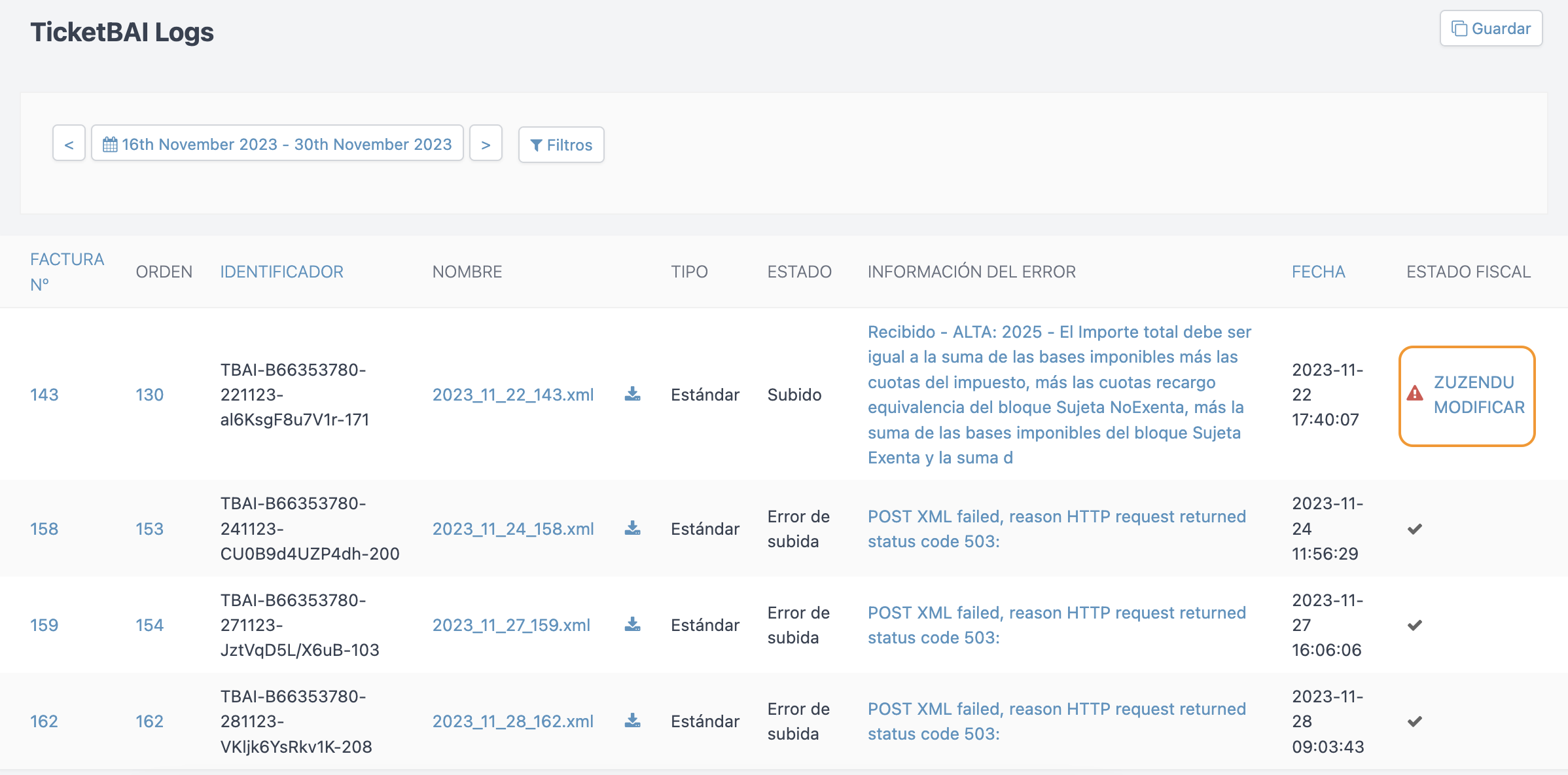

Within Files, the key columns are Order, Error Information, and Fiscal Status.

In the Fiscal Status column, you will see if the invoice has been uploaded correctly , if there is an error , or if it has been resent/rectified . Error Information details the type of error.

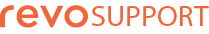

Click on the order number to view details and associated documents:

Knowing the associated documents is useful when correcting an invoice with a corrective invoice. In the image, corrective invoices are listed alongside the original invoice.

In the example image, you can see that the original invoice is first, invoice X-7 corrects the original, X-9 corrects X-7, and finally X-11 corrects the previous one and is correctly processed in TicketBAI.

To find invoices with errors, use the filter. Click on Filters and enter a hyphen (-) in Error Information. You will see invoices with errors and their status in Fiscal Status:

IMPORTANT: Each time you open an order, an invoice is generated. The invoice is sent to TicketBAI only after closing the order and completing the process.

Taxation in test mode

-

Description: For some reason, test mode has not been disabled, and work has been carried out normally.

-

Solution: You need to recreate the invoices to send them to TBAI.

Code 6016

-

Description: If it's a corrective invoice of any type, the SerieFactura must be identified.

-

Solution: Check that all counters in different invoices in the COUNTERS section have a unique prefix.

Also, check in the INVOICE SETTINGS section that the counter is associated with Simplified Invoice and Returns. It's important these counters do not overlap to avoid errors.

Once these points are checked, you need to open a case with REVO for review.

Code 2025

-

Description: The total amount must be equal to the sum of taxable bases plus taxes, plus equivalent surcharge taxes of the Sujeta NoExenta block, plus the sum of taxable bases of the Sujeta Exenta block and the sum of amounts.

-

Solution: Open a case with REVO for review.

Code 5016

This is an old bug that has already been fixed. If you find an invoice with this error, simply click on ZUZENDU MODIFY.

Code 005

-

Description: The file has already been received previously.

-

Solution: This error is purely informational. Click on the order and check if there are other associated invoices. Review the other invoices until you find the one that has been correctly uploaded.

If you see there is only one document, you need to open a case with REVO for review.

Code 021

-

Description: The file to be modified must have been previously received in the system.

-

Solution: Open a case with REVO for review.

Code 007

-

Description: Invalid sender certificate for invoice issuer.

-

Solution: Check that the client has informed TBAI that the invoices are generated through a certified software provider (third party) and that the certificate has been correctly submitted.

Code 1219

-

Description: The TipoImpositivo field must have a value other than 0 if the TipoNoExenta field is set to S1 and ClaveRegimenIVAOpTrascendencia or ClaveRegimenIVAOpTrascendencia adicional has a value other than 03, 05, or 09.

-

Solution: Ensure that all products have a valid VAT rate assigned. Once corrected, open a case with REVO to carry out the corrective substitution.

Code 003

-

Description: 003 - The file does not include detail lines

-

Solution: Check if the invoice and order contain items and press ZUZENDU.

If we see that there are no contents, we need to check that the order is closed. Once closed, check if the invoice has updated and added the contents. If it has, press ZUZENDU. If it has not, a case should be opened with REVO for further review.

If the order has no contents, the error cannot be solved. The order must be cancelled, with the counters skipped or left in error.

CODE 001

-

Description: 001 - Sender certificate missing on the client side, not authorised, revoked or expired.

-

Solution: If this is an issue with IZENPE, the platform used by TicketBAI to sign invoices, simply press ZUZENDU.

If pressing ZUZENDU does not solve the issue, contact REVO.

CODE 008

-

Description: 008 - The signing key has been revoked or is unknown.

-

Solution: If error 001 appears multiple times, it may eventually change to error 008. If this is an issue with IZENPE, the platform used by TicketBAI to sign invoices, simply press ZUZENDU.

If pressing ZUZENDU does not solve the issue, contact REVO.