1. CREATE THE ACCOUNT BY CONTACTING YOUR RESELLER 2. SET UP THE "TAX SETTINGS" SECTION IN YOUR ACCOUNT 3. SET UP PREFIXES IN THE COUNTERS 4. SET UP THE COUNTERS IN INVOICE SETTINGS 5. DISABLE "TEST" MODE

1. CREATE THE ACCOUNT BY CONTACTING YOUR RESELLER

To register a client in TBAI, you first need to create an account. Contact your official REVO reseller. The reseller will create the account and provide you with a document to sign so REVO can send invoices to TicketBAI.

In the case of TBAI Álava, once the certificate has been signed, this number (without the spaces) must also be given to TBAI, and it must be indicated that the invoices will be generated by a software guarantor.

2. SET UP THE "TAX SETTINGS" SECTION IN YOUR ACCOUNT

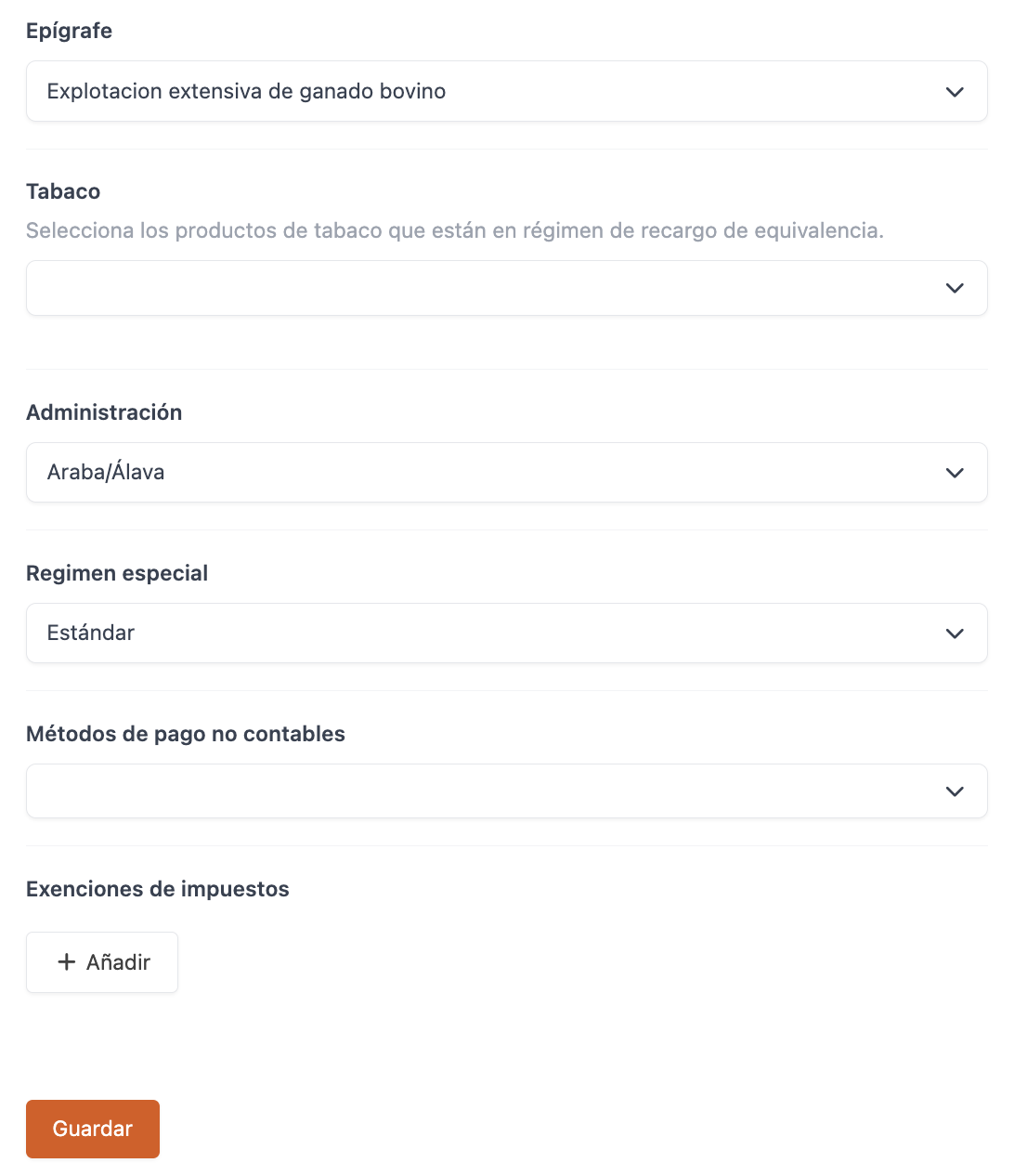

Configure the "Tax Settings" section, taking into account the fiscal differences in each province of the Basque Country: Gipuzkoa, Vizcaya, and Álava.

Go to Tax Settings in the back office. Enter your tax details: name or business name, address, tax identification number, etc.

-

Tax Country: Select Spain (Basque Country).

-

Test: Activate it while testing to avoid sending invoices to TicketBAI.

IMPORTANT: Once deactivated, this change cannot be reversed.

-

Taxpayer: Select Individual or Legal Entity.

If you select Legal Entity, not all mentioned options will appear.

-

First Name: First name of the owner.

-

Last Name: Last name of the owner.

-

Activity Code: Select the code appropriate for your services.

-

Tobacco: Indicate if it is under the equivalence regime.

-

Administration: Select your province (Gipuzkoa, Vizcaya, or Álava).

IMPORTANT: Once test mode is deactivated, the administration cannot be changed. Invoices sent to an incorrect administration cannot be transferred. They must be sent manually.

-

Special Regime: Select the applicable one.

-

Non-accounting Payment Methods: Select your non-accounting payment methods.

-

Tax Exemptions: Select in the first dropdown the tax created in the back-office, and in the second the exemption code.

-

Files: View the XML files sent to TicketBAI and their status.

3. SET UP PREFIXES IN THE COUNTERS

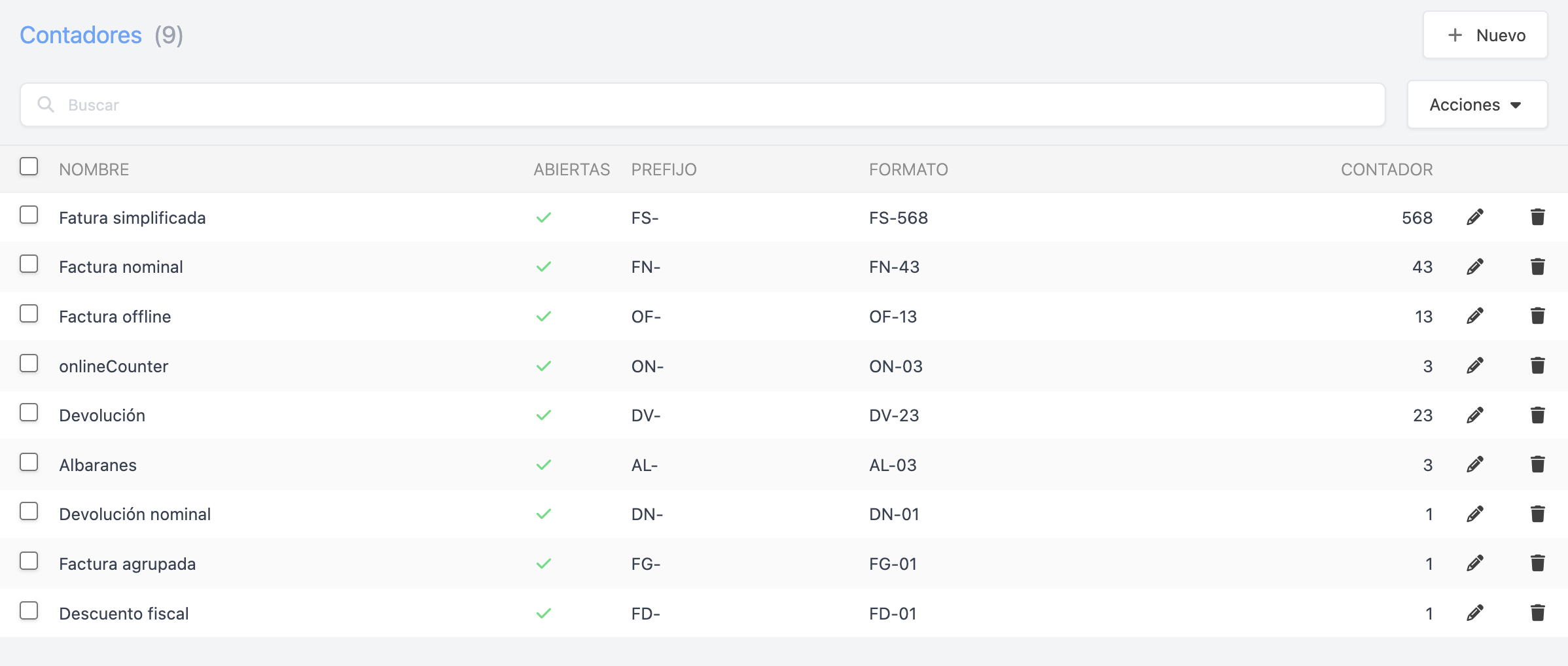

If you have a Master account with several subaccounts under the same tax identification code, set up different prefixes in the counters to avoid duplication in the invoice series sent to the tax authorities. This is important to maintain proper records and avoid errors when uploading invoices to TicketBAI.

To set up prefixes in the counters, go to Counters. Accessing from each subaccount, you can assign unique prefixes.

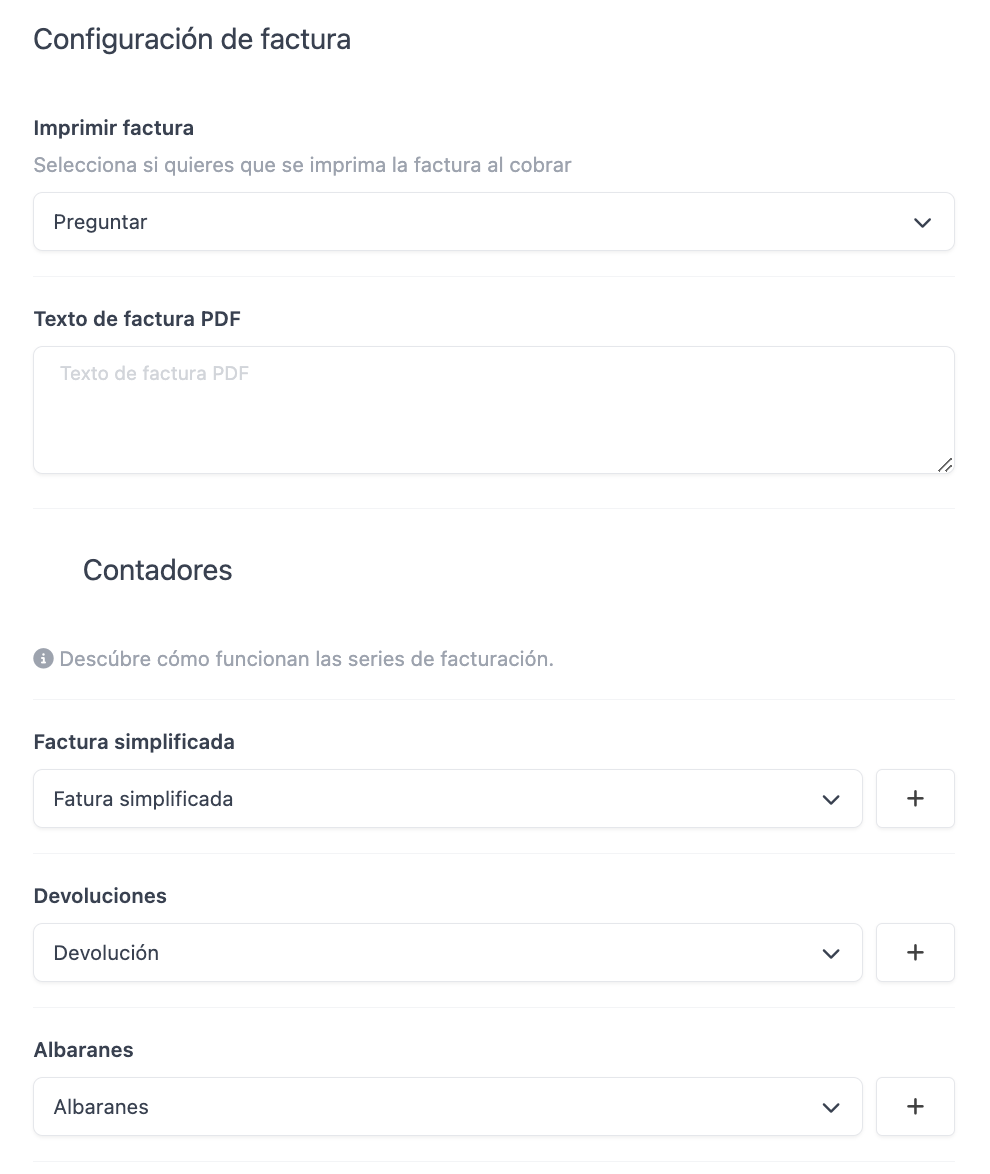

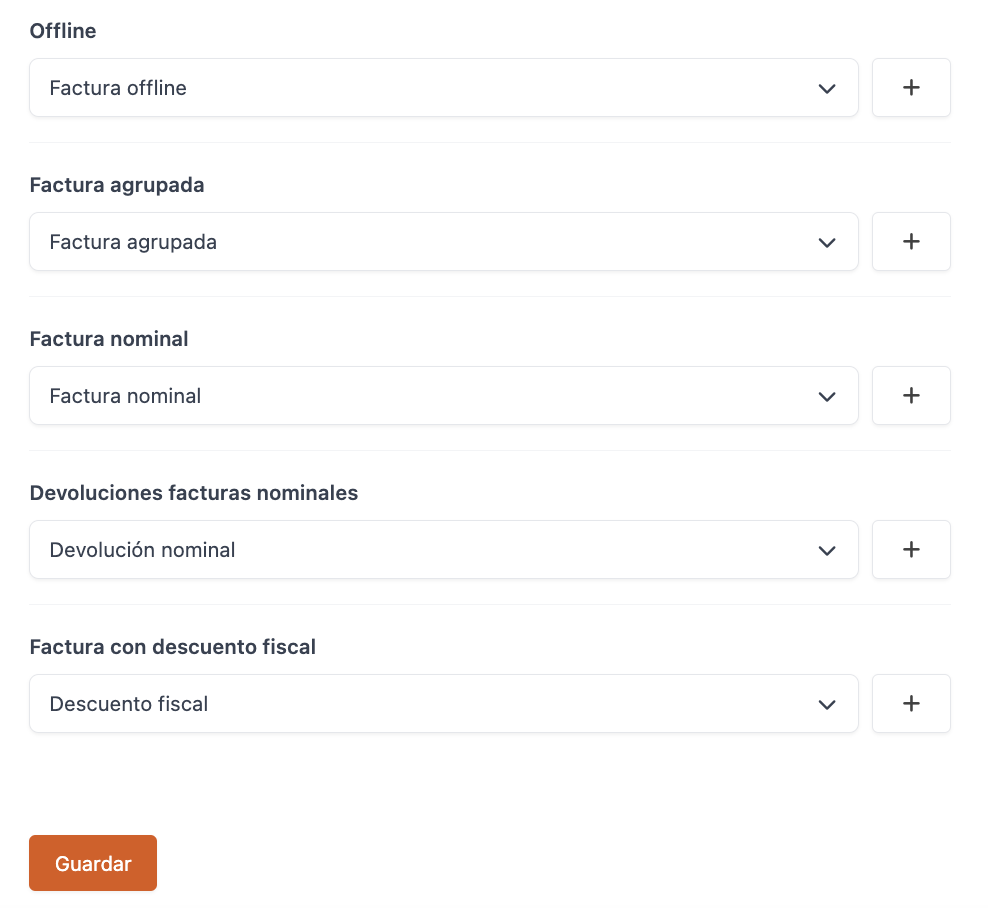

4. SET UP THE COUNTERS IN INVOICE SETTINGS

Once the counters are created, assign them in Invoice Settings.

Each invoice series must have its own counter, especially the "Return" and "Nominal Invoice Return" counters, otherwise the invoices will generate an error in TicketBAI.

5. DISABLE "TEST" MODE

Once all settings are complete, and you are ready to start your first shift, disable "test" mode in the tax settings. This will ensure that invoices are correctly sent to the tax authorities and officially recorded.

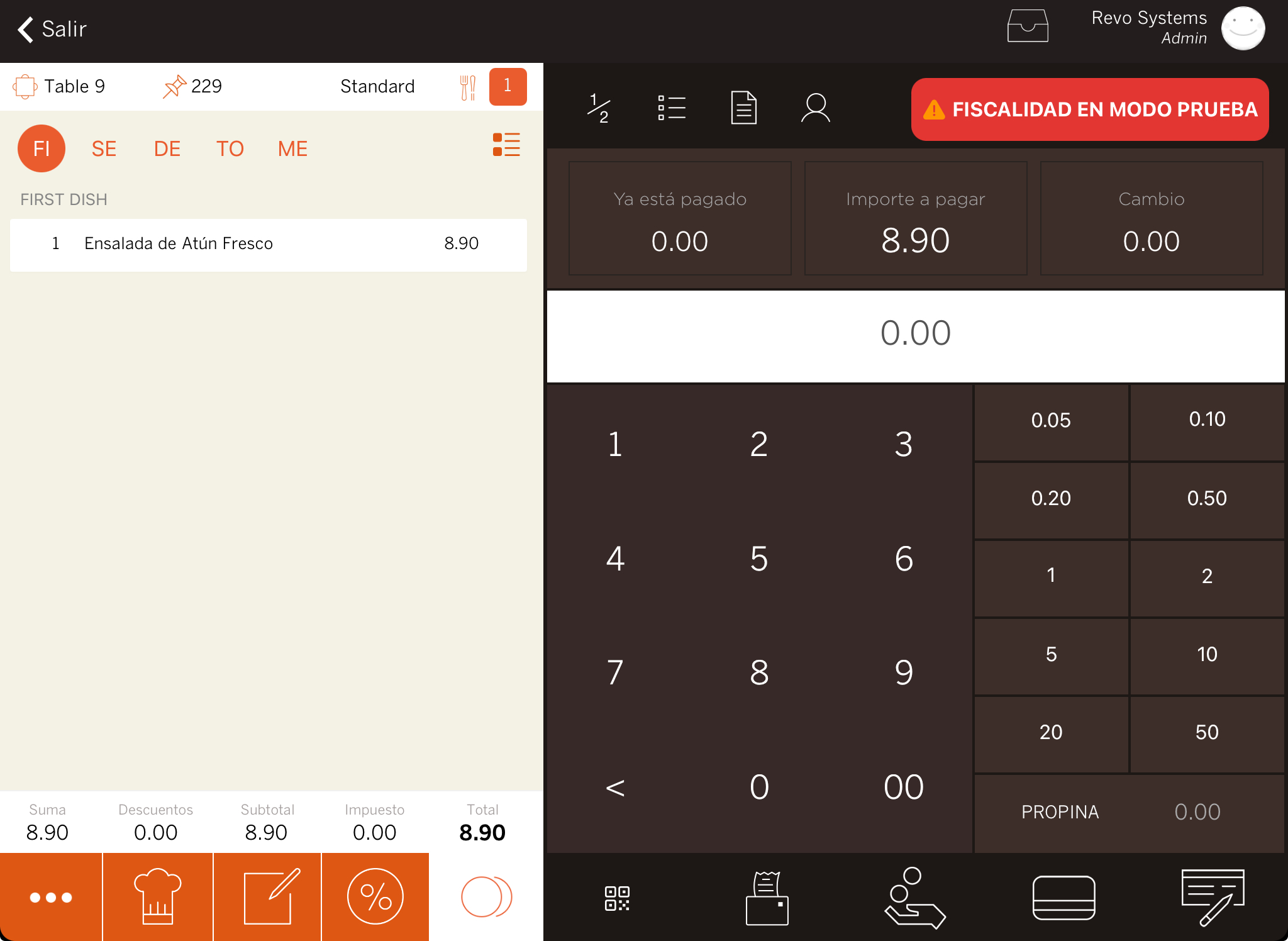

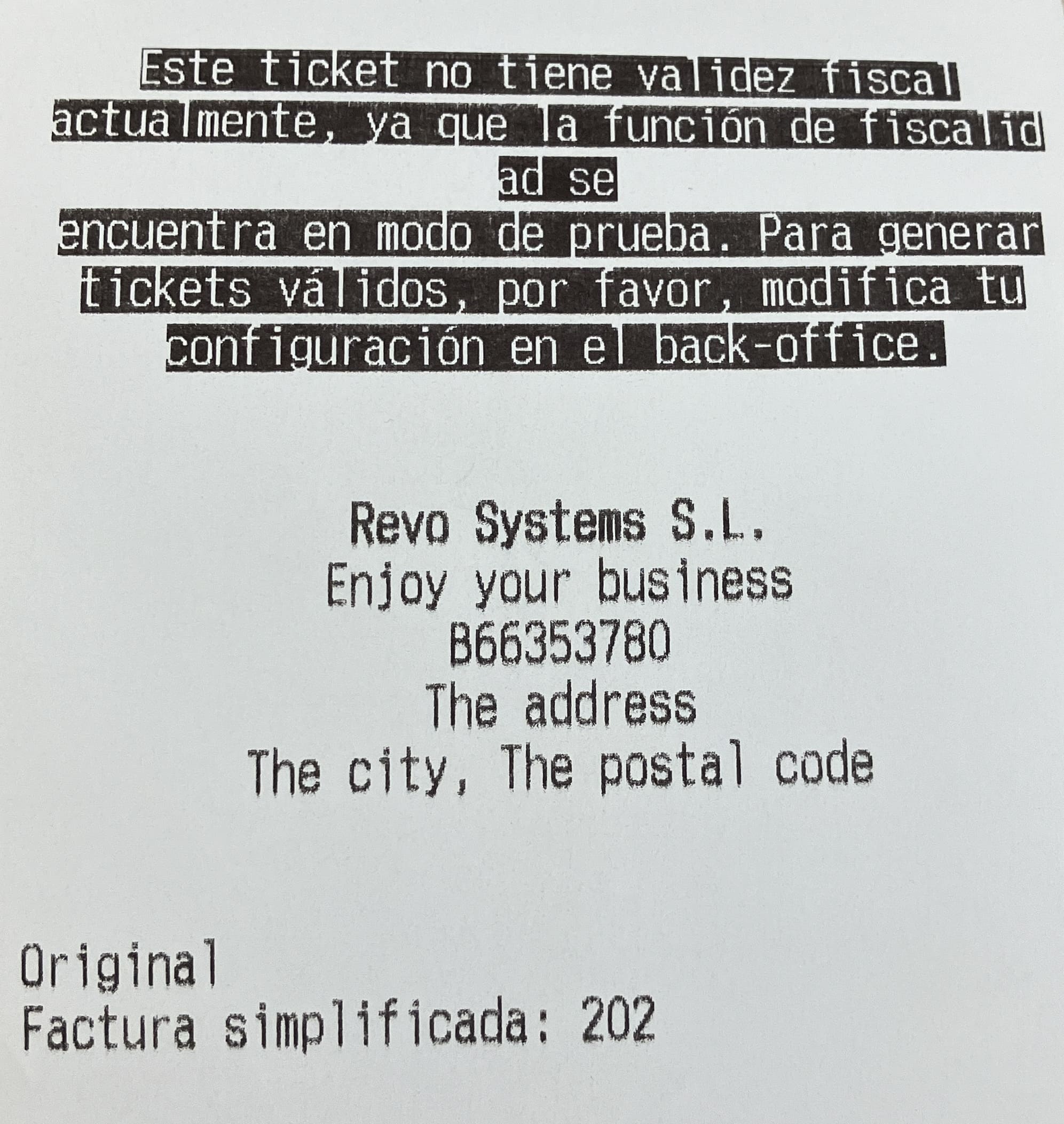

While test mode is active, an alert will appear on both the payment screen and the ticket: